Affordable investing for any budget

Create your account

BUX Basic

The most affordable way to start investing monthly with small amounts.

- €0,00 Monthly Service Fee

- 0,20% Variable Service Fee per year

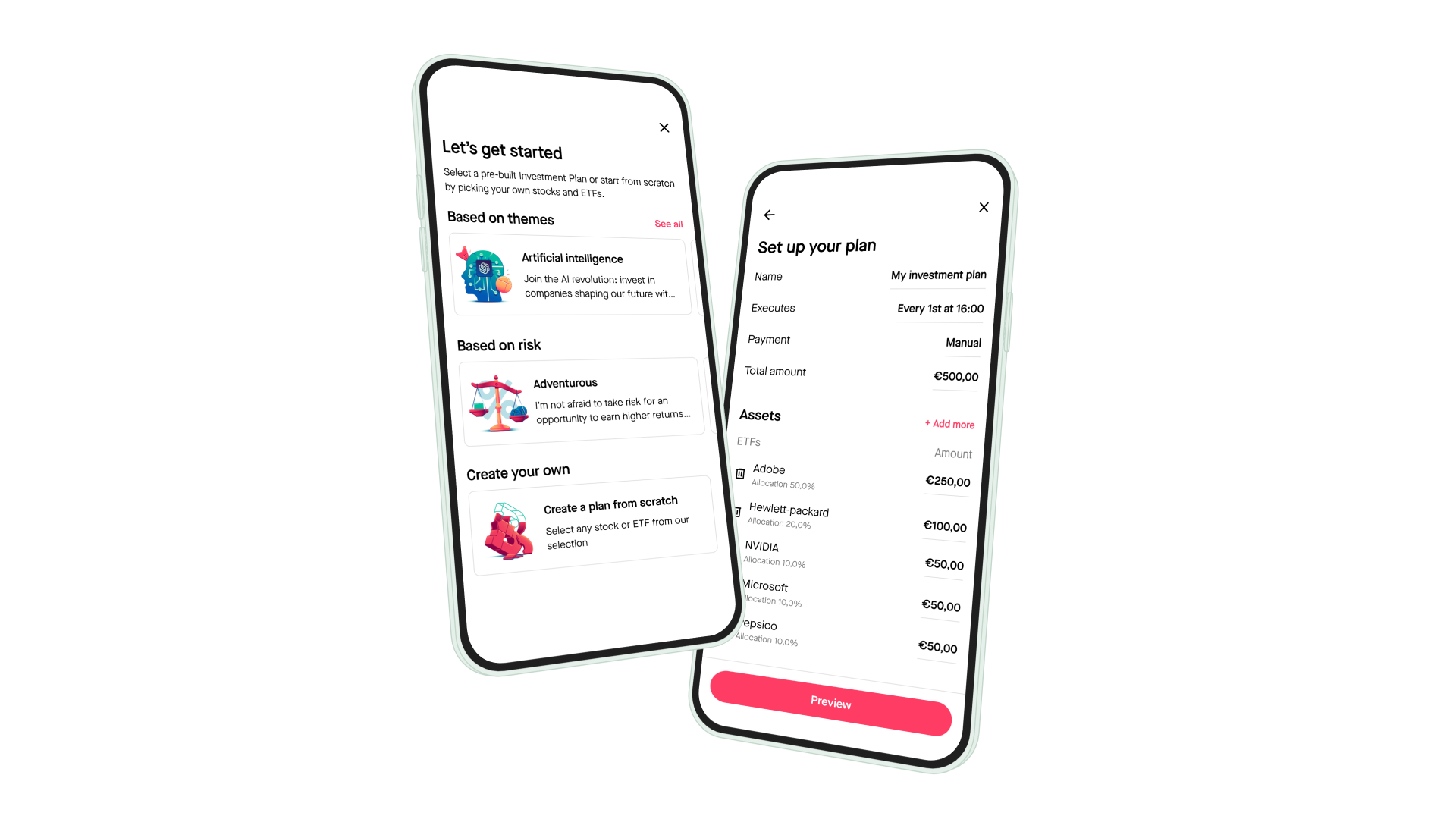

- Commission-free monthly investments plans

- Commissions up to €3,99 per order

- 0,75% FX markup on US stocks

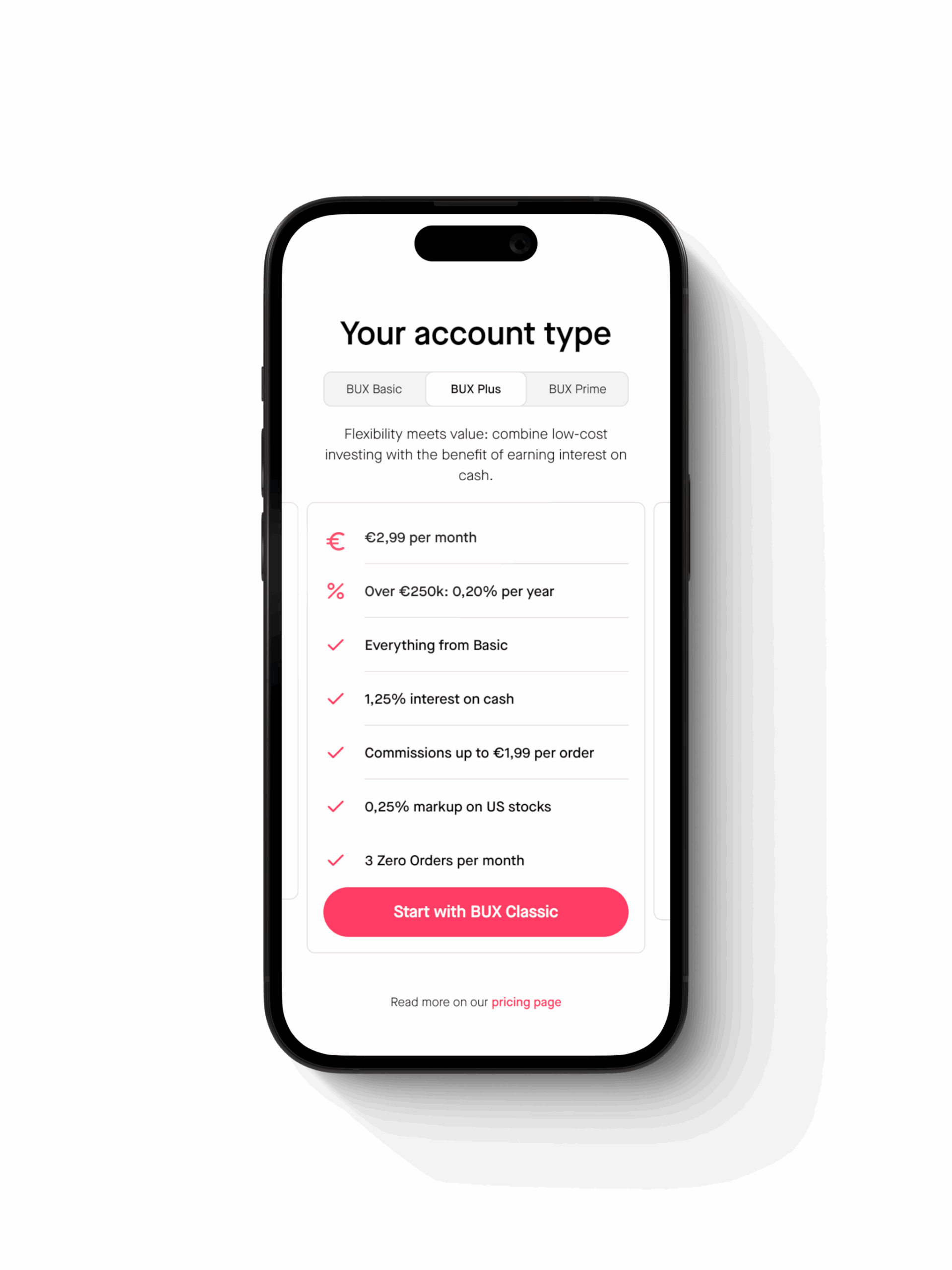

BUX Plus

Flexibility meets value: combine low-cost investing with the benefit of earning interest on cash.

- €2,99 Monthly Service Fee

- Over €250k: 0,10% Variable Service Fee per year

- Everything from Basic

- 1,50% interest

- Commissions up to €1,99 per order

- 0,25% FX markup on US stocks

- 3 Zero Orders per month

BUX Prime

Access to Active ETFs managed by J.P.Morgan without complexity of high fees of private banks. Lowest trading fees, highest interest on cash.

- €7,99 Monthly Service Fee

- Over €500k: 0,10% Variable Service Fee per year

- Everything from Plus

- Prime Plans created by J.P. Morgan experts

- 1,75% interest

- Commissions up to €0,99 per order

- 0,20% FX markup on US stocks

- 5 Zero Orders per month

You can switch between BUX Basic, BUX Plus and BUX Prime whenever you want. It will take a month to downgrade your account but you can upgrade immediately.

Account costs & benefits

| BUX Basic | BUX Plus | BUX Prime | |

|---|---|---|---|

|

Monthly Service Fee

|

€ 0,00 | € 2,99 | € 7,99 |

|

Variable Service Fee

|

0,20% |

0% below €250k |

0% below €500k |

|

Interest²

|

0% |

1,50% on up to €100k |

1,75% on up to €100k |

|

Order types

|

Investment Plan Order |

Investment Plan Order |

Investment Plan Order |

|

Deposits & Withdrawals

|

€ 0,00 | € 0,00 | € 0,00 |

|

Stock Lending Revenue Share³

|

50% | 50% | 70% |

Other fees

| BUX Basic | BUX Plus | BUX Prime | |

|---|---|---|---|

|

Real-time market quotes

|

€ 0,00 | € 0,00 | € 0,00 |

|

FX markup (only US)

|

0,75% | 0,25% | 0,20% |

|

Sign up for shareholders meeting

|

€10 (incl. VAT) |

€10 (incl. VAT) |

€10 (incl. VAT) |

Execution costs

Selling stocks and ETFs bought through an investment Plan is subject to the costs below.

Our zero-commission order. This order is executed at the end of the trading day, between 4pm (CET) and market close.

This order is executed directly at the best available market price.

This order is executed at a predetermined price. Limit Orders specify the maximum price you are willing to pay when buying or the minimum price you want to receive for selling.

This order is a Limit Order that doesn’t expire.

¹ When upgrading to a higher tier you will be charged immediately upon switching tiers, instead of monthly.

² Interest on uninvested cash is paid by ABN AMRO Clearing Bank

³ We deduct operational costs and 3rd party lending agent fees from the gross return paid by borrowers. This net annualised return is then shared with you. On BUX Prime you get 70% and on BUX Basic or Plus you get 50% of the net annualised return. As of 21 July this implies that Prime clients receive 45.5% and BUX Basic and BUX Plus clients receive 32.5% of the gross rate paid by borrowers. Please note that these aggregated costs will fluctuate based on actual operational costs incurred by BUX and arrangements with lending agents. For more information on how much you can earn and the risks, visit our dedicated webpage.

⁴ Fractional buy and sell orders can only be made via market orders. Relevant market order pricing will apply.

⁵ For a further description and the the specific risks of the BUX Zero Order, please see our product product information sheet.